In 2020 we entered into partnership with Buck Collins — ex-professional ballet dancer, mortgage industry expert and kindred spirit — as co-founders of the Plus Platform.

The goal of this new business is simply stated, but the ambition is enormous. We want to re-imagine, disrupt and transform one of the biggest and least technologically-sophisticated financial markets in the entire world — the US residential mortgage.

The Challenge

In the United States today, mortgage whole loan and securitisation processes are behind the curve. They involve disparate steps, isolated spreadsheets and siloed databases.

Plus aims to change all of that by creating a digital loan platform that represents the thousands of data points of a loan into code.

Easy, right?

The Solution

Digital product creation is our bread and butter. We knew exactly where to start, regardless of how big a challenge we faced. With a solid Discovery phase.

We began with brand and identity work, clearly articulating the proposition and messaging. From there we workshopped the necessary components and technologies we’d need to make it a reality. And then the shape of our new product began to emerge.

Although the foundations of Plus Platform were becoming clear, we still had significant challenges ahead of us — like figuring out how to engineer digital mortgages. We assembled a brilliant and enthusiastic engineering team and immediately conducted a number of technology spikes to find the right path forward.

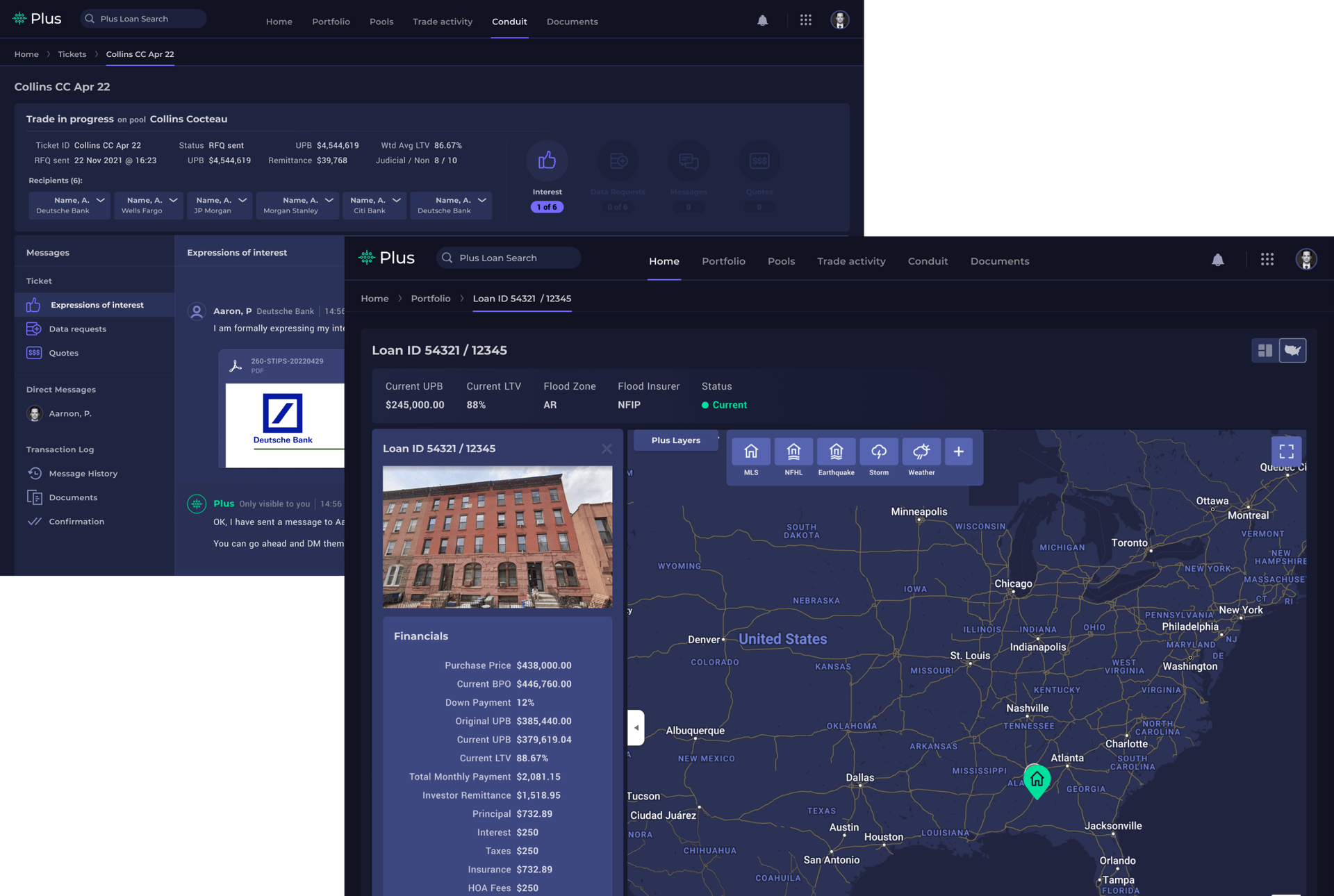

Our solution was the Smart Loan. It’s a new kind of digital debt instrument for the mortgage market. In the Smart Loan, all of the thousands of data points of a loan, and all of the changes that might occur throughout the lifetime of that loan, are represented in code. And this use of cutting edge technology replaces subjective interpretations with objective data — leading to consistent and measurable outcomes.

Our production goals were no less ambitious, but we met them all: proof-of-concept in December 2020, our first MVP nine months later and our Candidate v1.0 at the end of 2022.

The Outcome

Bringing the Plus Platform to life has been an incredible challenge across design, logistics, data and engineering. From the Smart Loan concept and implementation itself, to the data ingestion and OCR integration. And, of course, creating an entirely new digital loan trading proposition.

But this new platform will help users to achieve consistent and measurable outcomes based on objective data rather than subjective interpretations. Which in turn, has the potential to impact many lives across the US. Which means it’s exactly the kind of work we set out to do when we established Fathom.

And we couldn’t be more excited to see what the future holds.