Access Fintech helps firms track risk and visualise trade lifecycle across today’s increasingly complex financial ecosystem. To date, they’ve raised $97 million funding for the platform we helped create and are the benchmark application in their industry.

The Challenge

Back in 2016, the adoption of new Fintech was being held back by concerns around control, regulatory requirements and cost. And potential customers were suffering from vendor management fatigue in an increasingly crowded landscape. It was a problem full of opportunity.

Access FinTech recognised the need for a platform capable of both simplifying risk management and allowing customers to manage vendors without extensive configuration or expensive commitment. But Roy Saadon, the founder and CEO, realised they’d need a design and technology partner to succeed.

Roy’s brief was to create an intuitive, self-service risk management platform that worked across devices and platforms — and which required no instruction manual.

The Solution

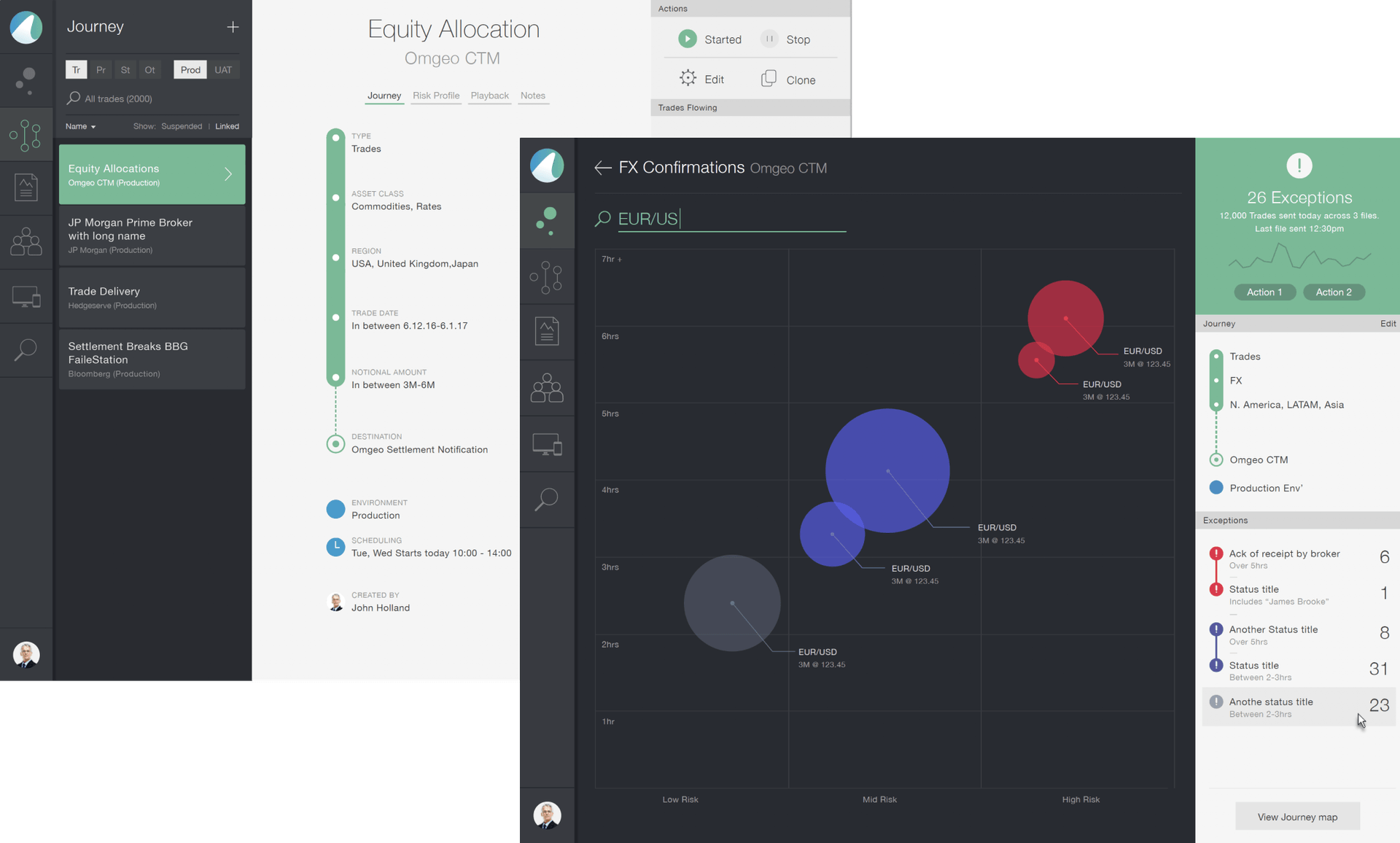

The initial phase of the engagement involved unpacking and clarifying the product vision, and defining all the key aspects of the offering through rigorous UX design and analysis. And on this particular project, that included the creation of a completely new data visualisation language.

Our dedicated development team immediately started work on a prototype. Rather than taking a list of technical specifications as their initial brief, the team worked from key data visualisation screens. We delivered interactive application screens rather than mockups, which helped us to discover new opportunities and features quickly.

The Outcome

Through intensive cross-discipline workshops, expert UX guidance and stunning visual design, we brought the Access Fintech concept to life in ways the client had never imagined possible.

The Access Fintech solution has become the benchmark application against which aspiring fintech products are judged. The platform facilitates a wide variety of digital collaboration across disparate financial ecosystems, enriching data and visualising both risk and exceptions in intuitive, elegant ways.

And they've received $97 million funding to date.